+ Make a Direct Action Donation

Direct Action donations are our greatest need. They can fund everything we do, including directly lobbying elected officials, running grassroots organizing campaigns, and advocating for or against legislation. They are not tax-deductible.

+ Make a Charitable Donation

Charitable donations can only fund our education, organizing, and programming.

A donation of $500 or more to Bikemore from an individual or business can receive a Maryland Community Investment Tax Credit (CITC) worth 50% of the donation, in addition to your regular charitable contribution deduction you may be eligible for on your state and federal taxes. You can learn more at the GIVE Maryland website.

Recurring Donations

If you've set up a recurring donation to Bikemore and need to update your card information, donation amount or frequency, you can now update your info online:

DONOR FAQ’s

Have questions about your donation, our events, or how to get more involved? Click here to to view some frequently asked questions!

+ Click to Learn more about Direct Action vs. Charitable Donations

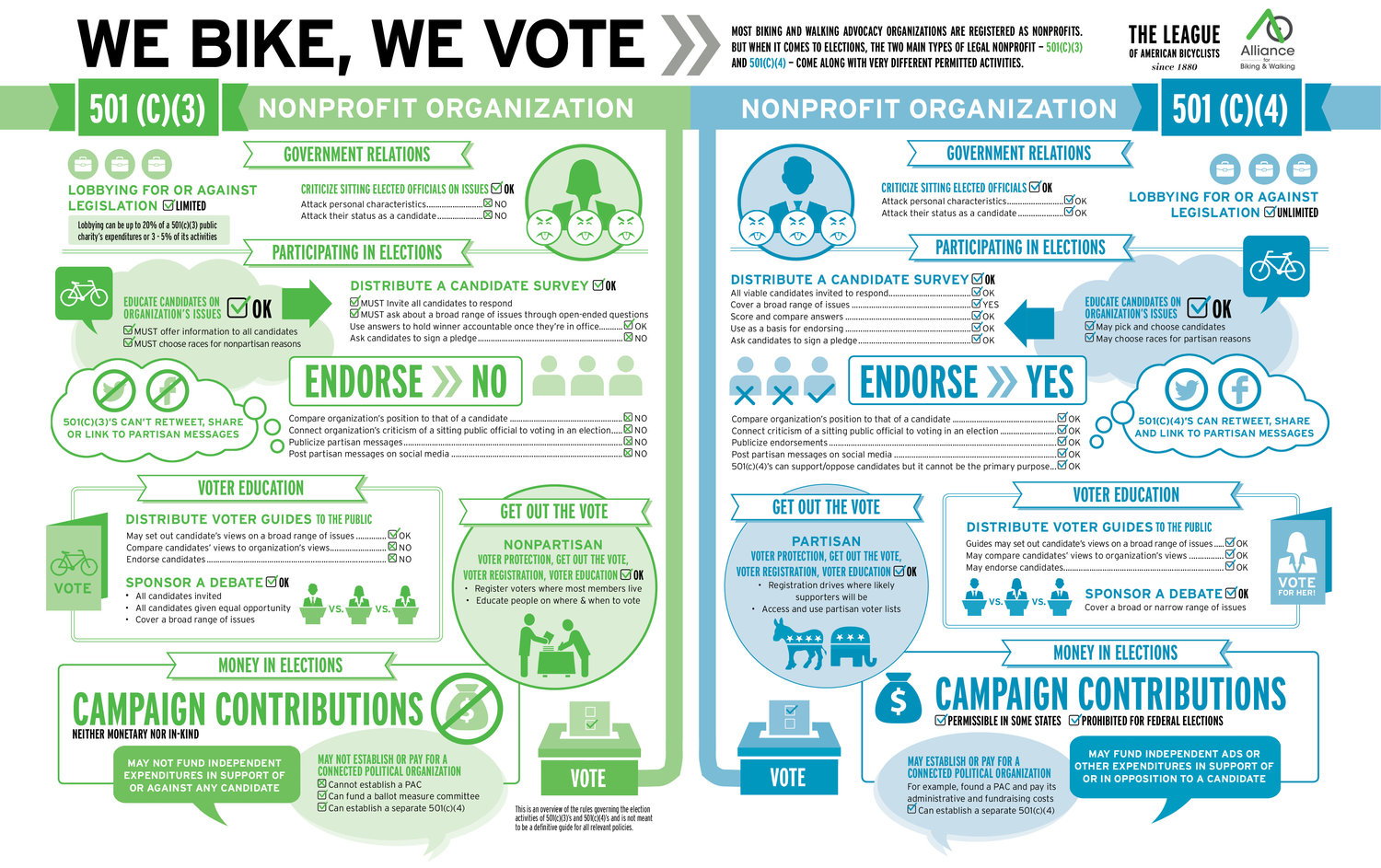

Our direct action work is through Bikemore in Action, a 501(c)(4). Our charitable work is through Bikemore, a 501(c)(3). See below for an infographic for more information on what we can do with these different tax statuses.

One last tip: unless you itemize your taxes, the charitable deduction isn't really important. Take the standard deduction? Go with a Direct Action donation.